How to Trade Carbon Credits

Trade Carbon Credits

Trading carbon credits allows upstream industries to reduce their risk and meet their climate targets. These credits can be purchased or sold by companies and governments alike. It is important to remember that they are only used to offset emissions that cannot be reduced directly. There are many ways to purchase and sell carbon offsets, such as through online brokerages, a specialist trader, or an exchange.

When trade carbon credits, the buyer and seller are financially rewarded for the reduction of CO2 emissions. In this way, the market can avoid artificial winners and losers. However, there are still some structural issues with the carbon markets that need to be addressed. For instance, the trading system has been characterized as “fraught with scandals.” It is unclear what impact these have on the future of the carbon markets, especially as many countries have pulled out of the Kyoto Protocol.

Some environmental groups say the carbon trading process has been rife with fraud. In some cases, they argue that polluting emissions are transferred from one company to another. That is, if a company cuts its emissions, its pollution is transferred to another company that will use it to power their factories or businesses.

How to Trade Carbon Credits

But in reality, it isn’t as simple as that. To ensure the validity of the emission reductions, a third-party auditor must check whether the company’s actions will actually reduce greenhouse gases. Typically, carbon credits are traded in volumes of at least one metric ton.

Some large corporations have invested in offsets for historic emissions, such as Microsoft. The corporation plans to use its carbon offsets to compensate for all of its emissions from past years. It acquired 1.3 million carbon offset credits in 2021. In addition to this, the company has pledged to buy enough carbon credits to cover all of its historic emissions.

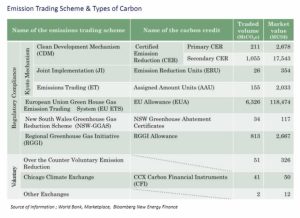

Similarly, the US has created a group called the Regional Greenhouse Gas Initiative. The organization was formed by the states of New York, Massachusetts, Connecticut, Maryland, and Rhode Island. Several other states have also formed their own regional greenhouse gas initiatives.

These schemes allow the upstream industries to trade their carbon credits, and they are usually short-term. The companies that need to increase their allowances must buy credits from other companies that have lower emissions. These companies can then continue to operate as usual.

The European Union Emission Trading Scheme is the largest GHG emissions trading scheme in the world. It was first introduced in 2005. It consists of a national allocation scheme, and an organization must provide the appropriate amount of EU allowances to cover its emissions. If an organization does not have enough allowances, it is fined. It can then sell surplus credits to other organizations.

There are several exchanges for large companies and businesses to trade their credits. But some individuals are apprehensive about the value of these credits. Generally, the amount of credits in the market is low, so big companies need to cut their emissions.