How Can Trade Carbon Credits Be Traded?

Trade Carbon Credits Be Traded

A carbon credit is a tradable permit that gives the holder the right to emit one metric ton of CO2 or other greenhouse gases (GHG) over a specific time period. The underlying project that generates the credit must be independently verified by a third party to ensure its environmental performance and meet strict international standards. This makes it a legitimate financial tool to encourage companies and individuals to lower their GHG emissions.

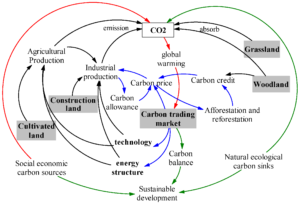

A credit can be purchased either in a compliance or voluntary market. The former – usually run by governments or regulatory bodies – incentivizes businesses with high GHG emissions to reduce them. The latter – which is rapidly gaining traction – allows businesses to offset their emissions by purchasing credits from other projects that have achieved them. The idea is that the resulting GHG reductions are as good as, or better than, those made by the purchaser’s own business operations.

In a compliance market, a large trade carbon credits is called an allowance, and the value of that allowance can be exchanged for cash or other assets. Businesses must buy credits if they exceed their limit, or sell them if they have surplus allowances after reducing their emissions below the cap.

How Can Trade Carbon Credits Be Traded?

The price of a credit varies according to several factors, including the size and geographical area of the underlying project, its vintage, and its delivery date. The price can also be influenced by whether the underlying project helps to achieve the UN’s Sustainable Development Goals (SDGs), as this increases its appeal to buyers.

As a result, credits are typically traded through specialist brokers, and retail investors can’t invest directly in them. Instead, there are a number of carbon ETFs – or exchange-traded funds – which can be traded on traditional stockbroker platforms. Some are even available on popular investment apps.

Aside from these ETFs, individual consumers can’t trade carbon credits directly, and are unlikely to be able to purchase them as they are sold primarily to corporate and institutional buyers. However, the emergence of new climate finance legislation is set to change this. For example, the Growing Solutions Act, which is currently waiting to be heard in the House, would allow farmers, ranchers and foresters to learn how to sell carbon credits.

There are a number of ways to link supply and demand, although the majority of trading in carbon credits still takes place in private conversations or over-the-counter. Increasingly, exchanges are emerging to help streamline the process and provide a more transparent and efficient platform for connecting carbon sellers and buyers. These exchanges include Xpansiv CBL and ACX, both of which have developed standard products that ensure certain basic specifications are met. The prices of credits that trade under these labels are therefore more predictable than the broader market. In addition, these standard products help to reduce transaction costs for both parties. This makes it much easier to link a company that wants to purchase its credits with a producer that wishes to sell them.